UST Reserves Increase Demand for Already Scarce Bitcoin

Cash.Tech Newsletter #25: Terra unrelentingly stacks $1.7B in BTC for UST stablecoin

Stablecoins are critical components of the crypto ecosystem providing fiat on-ramps and serving as a tool for investors to hedge exposure to volatile markets. There are currently over 75 stablecoins with a majority backed by different fiat currency reserves. However, a recent decision by TerraForm Labs to use Bitcoin as a reserve asset for the Terra USD (UST) stablecoin proves that these fiat-pegged assets could generate immense demand for scarce BTC.

This edition of the Cash.Tech Newsletter breaks down the rise of the Luna Foundation Guard (LFG) to the top of the Bitcoin ownership ranking. We also review the controversial Terra USD (UST) stablecoin and the key takeaways for cryptocurrency investors observing these developments. First, we will bring you some development updates from the Cash.Tech team.

Cash.Tech development update

This week, the team continued the development of the Cash.Tech Merchant Protocol. The team implemented some front-end parts of the product payment features for customers. As shown in the screenshot below, users can now preview their product purchases, including pertinent information such as merchant name, product, etc.

Another newly introduced feature is the currency selection option that allows the customer to choose their preferred crypto for payment. The merchant’s address and payment amount is automatically filled, with the customer only reviewing and confirming the purchase amount.

These integrations continue to bring the Merchant Protocol towards its final release in the coming weeks. The team is continuing the development of the API for the actual product payment. Once this is completed, the API will be connected to the front-end, making the application ready for beta testing and eventual release!

The team is already preparing a teaser video highlighting the exciting features of the Merchant Protocol and look forward to sharing it with the community soon. Rest assured, the process to list the current app version on the Apple Store is also ongoing.

Fast-growing UST Bitcoin reserves top $1.7B in under a month

Terra USD (UST) is an algorithmic stablecoin launched by Terraform Labs, the team behind blockchain project Terra. Unlike most stablecoins where issuers are required to hold a 1:1 USD reserve to back issued tokens, Terra embraces an algorithmic model to ensure backing.

Put simply, users seeking to mint the UST stablecoin need to burn Terra (LUNA) equivalent to the amount of stablecoins required. The same process is repeated concurrently during redemption as users need to burn UST to receive their LUNA tokens in return.

However, UST still faces the same risks as other algorithmic stablecoins that have failed so far. Market conditions that result in loss of confidence in UST could result in many holders seeking to redeem their holding enmasse. Some examples of other failed algorithmic stablecoin experiments that suffered the same fate include Iron Finance (IRON), Fei (FEI), and Celo Dollars (CUSD). In fact, UST has once suffered a de-peg event in the past, with the price of the stablecoin dropping around $0.92 in May 2021.

(Source: CoinMarketCap)

The likelihood of a repeat had raised fears among UST holders despite a mouthwatering yield (up to 20% APY) for staking. To solve the problem, the Terra team decided to begin a transition from a fully-algorithm backed stablecoin to one primarily backed by Bitcoin (BTC). This model would boost public faith in the stablecoin and ensure that in the event of a catastrophic failure, users could redeem their UST tokens for BTC and other cryptocurrencies held in reserves.

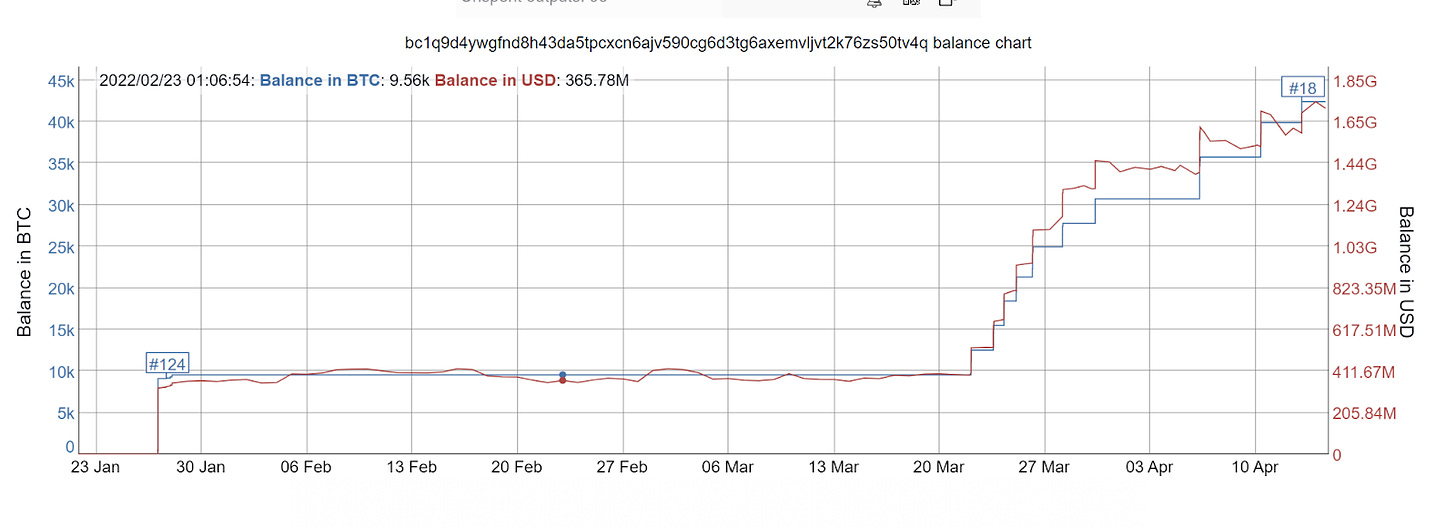

The Luna Foundation Guard (LFG), a non-profit entity, was set up and charged with maintaining the reserves for UST. The chart below shows how the LFG Bitcoin wallet has grown its Bitcoin reserves since late January and now holds 42,406 BTC ($appr. $1.7 billion).

(Source: Bitinfocharts)

At the time of writing, Terra’s LFG Bitcoin balance makes it the 18th largest holder in the world. The foundation’s stash is now less than 1,000 BTC away from surpassing 43,200 BTC (appr. $1.72 billion) held by Elon Musk’s Tesla.

Bitcoin’s fixed supply mechanism makes the LFG’s recurring purchases a trend to watch, especially with Terraform Labs founder Do Kwon mentioning that the stablecoin reserves could top $10 billion in the near future. Barring other market dynamics, here’s how Bitcoin has fared in the short-term since LFG stepped up its purchases on March 22, 2022.

(Source: Tradingview)

Will BTC become standard for algorithmic stablecoin reserves?

The long-term effects of growing a stablecoin reserve denominated mostly in freshly purchased BTC is unknown. If Terra succeeds in using Bitcoin to backstop a de-peg of its UST stablecoin, there is a greater chance that most existing and upcoming algorithmic stablecoin protocols will follow this trend.

Meanwhile, LFG still has a long way to go with its purchases given it only has appr. $1.7 billion backing the over $17 billion worth of UST in circulation at the time of writing. Bitcoin Investors do well to recognize that the native-crypto industry can generate substantial demand for BTC in addition to growing institutional accumulation of long-term bitcoin. These factors put Bitcoin and the broader cryptocurrency industry in line for steady growth into the foreseeable future.

Access your favorite stablecoins with Cash.Tech

Cash.Tech is a user-friendly wallet solution for investors to unlock all the possibilities of crypto in a fully self-custodial fashion. Cash.Tech already supports the secure storage of crypto assets, including the UST stablecoin. Upcoming features such as the Merchant Protocol and the integration of additional blockchain networks like Terra would make Cash.Tech the only wallet you’ll ever need to be part of the crypto revolution.